|

|

|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

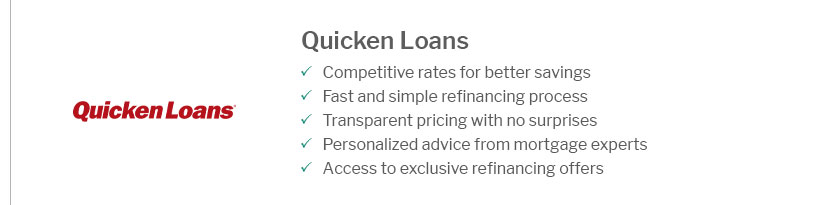

Exploring the Best Mortgage Lenders: A Comprehensive GuideIn the intricate landscape of real estate financing, selecting the right mortgage lender stands as a pivotal decision for prospective homeowners. With an array of options available, each offering distinct advantages, it's imperative to navigate this realm with a discerning eye and informed perspective. Let's delve into what constitutes the best mortgage lenders and how to identify them amidst a crowded marketplace. Understanding Your Needs: Before embarking on your journey to find the ideal lender, it's crucial to first assess your financial situation and long-term goals. Consider factors such as your credit score, the size of the down payment you can afford, and the type of property you're interested in. This preliminary evaluation will help streamline your options and tailor your search for lenders that align with your unique circumstances. Attributes of Top Mortgage Lenders: The best mortgage lenders are typically characterized by competitive interest rates, a variety of loan options, excellent customer service, and a seamless application process. It's worth noting that while some lenders may excel in offering low rates, others might stand out for their exceptional customer support or innovative digital tools. Reputation and Trustworthiness: One of the first aspects to consider is the lender's reputation. Established names in the industry often come with a proven track record and reliability, but it's equally important to explore customer reviews and ratings. Websites like the Better Business Bureau or Trustpilot can provide valuable insights into customer experiences. Interest Rates and Fees: While it might be tempting to choose a lender solely based on interest rates, it's essential to look at the bigger picture. Pay attention to the Annual Percentage Rate (APR), which includes both the interest rate and any associated fees, providing a more comprehensive cost of borrowing. Additionally, be aware of any hidden fees that might not be immediately apparent. Loan Options and Flexibility: A lender's ability to offer a range of loan products is another critical factor. Whether you're interested in a fixed-rate mortgage, adjustable-rate mortgage, FHA loan, or VA loan, the availability of diverse options can greatly influence your decision. Moreover, some lenders offer flexible terms that can be tailored to fit your specific needs, which is invaluable for many borrowers. Customer Service and Support: Never underestimate the value of responsive and knowledgeable customer service. The mortgage process can be complex, and having a reliable point of contact can make the experience far less daunting. Seek out lenders known for their transparency, willingness to answer questions, and ability to guide you through each step of the process. Technology and Accessibility: In today's digital age, the convenience of online applications and account management cannot be overstated. Many of the best mortgage lenders offer robust online platforms that simplify the application process, track loan progress, and provide timely updates. This level of accessibility is particularly beneficial for tech-savvy individuals who prefer handling transactions online. Noteworthy Lenders: While it's challenging to pinpoint a one-size-fits-all solution, several lenders have consistently received accolades for their offerings. Quicken Loans, known for its streamlined application process and customer satisfaction, stands out as a popular choice. Wells Fargo is another notable mention, especially for those seeking a variety of loan options and a wide network of branches. For those prioritizing low rates, LoanDepot often emerges as a strong contender. Conclusion: Ultimately, the quest to find the best mortgage lender requires careful consideration and due diligence. By evaluating your personal needs, examining lender reputations, and weighing the pros and cons of each option, you can make a decision that not only secures your financial future but also enhances your home-buying experience. Remember, the right lender is not just a financial provider but a partner in your journey to homeownership. https://www.consumeraffairs.com/finance/finance__companies.htm

Based on customer reviews, AmeriSave has a relatively easy-to-navigate online application, helpful loan officers and competitive interest rates. https://www.nerdwallet.com/article/mortgages/how-to-choose-a-mortgage-lender

One of NerdWallet's top pieces of advice for home buyers is to compare three or more mortgage lenders. That's because shopping around could ... https://www.bankrate.com/mortgages/reviews/florida/

Chase Home Lending, a division of JPMorgan Chase & Co., is one of the top mortgage lenders in the U.S. One of the big-box lenders with national... Read review.

|

|---|